Hinduja-Backed IIHL Completes Acquisition of Reliance Capital

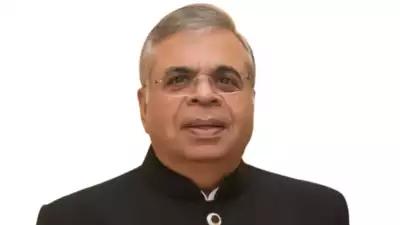

In a significant move within the financial services sector, Hinduja Group-backed IndusInd International Holdings Ltd (IIHL) has finalized the acquisition of the debt-ridden Reliance Capital (RCAP). Ashok Hinduja, chairman of IIHL, confirmed the completion of the transaction, stating, "The transaction from our side is over. As we are speaking, money is moving from one escrow to another."

This acquisition marks the beginning of a journey towards value creation, with Hinduja estimating the value of Reliance Capital's business at Rs 20,000 crore on a conservative basis. IIHL plans to review the entire RCAP business and determine the necessary fund infusion required for its revival.

Strategic Plans for the Future

With approximately 39-40 entities under Reliance Capital, the new management is set to divest many small shell entities with minimal business operations. Despite these changes, the financial services firm, which employs 1.28 lakh individuals, assures the protection of employee interests to the greatest extent possible.

IIHL's acquisition of Reliance Capital is a strategic move aimed at expanding its portfolio in the banking, financial services, and insurance (BFSI) sector. Having emerged as the successful resolution applicant with a bid of Rs 9,650 crore under the Corporate Insolvency Resolution Process (CIRP) in April 2023, IIHL has secured all necessary regulatory approvals from the Reserve Bank of India (RBI), the Insurance Regulatory and Development Authority of India (Irdai), and relevant stock and commodity exchanges.

Reliance Capital, which was placed under RBI-appointed administration in November 2021 due to governance lapses and payment defaults, has now embarked on a new chapter under IIHL's stewardship, promising a future of stability and growth in the BFSI sector.

Comments