Foreign Portfolio Investors' Mixed Signals in March

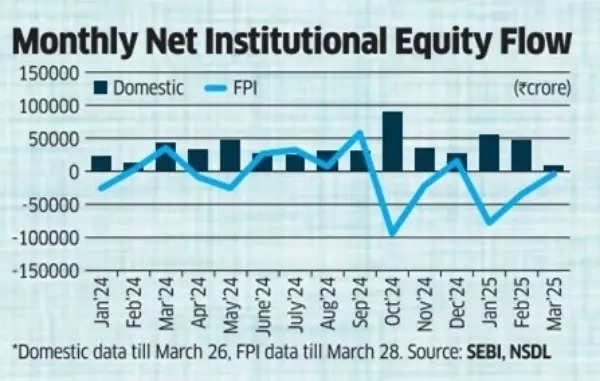

Foreign portfolio investors (FPIs) showcased a contradictory investment pattern in March, marking their third consecutive month as net sellers of Indian equities. However, a significant reduction in outflows was observed, thanks to a robust buying spree in the latter half of the month.

Investment Highlights

FPIs invested a net sum of ₹26,042 crore ($3,037 million) in the second half of March, a stark contrast to the ₹30,015 crore ($3,438 million) outflow during the first fortnight. The overall monthly net outflow decreased to ₹3,973 crore ($401.2 million).

Factors Influencing Future Investments

The future levels of foreign investment in India are poised to be influenced by several factors, including the trade policies under the US President Donald Trump’s administration, the Indian economy's appeal compared to the recession-threatened US market, and the valuation of domestic equities.

Domestic Funds vs. FPIs

Domestic funds displayed an opposite trend to FPIs, with their net equity investment in March totaling ₹9,147.6 crore, lower than the ₹13,516.6 crore invested until March 7. This indicates a reduction in equity positions by local funds during the month's latter period, contrasting with the increased purchases by foreign investors.

Comments