Global and Domestic Factors Impacting Dalal Street

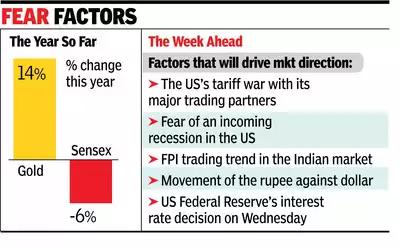

As trading resumes on Dalal Street, investors are closely monitoring several global and domestic factors that could influence market sentiment. The ongoing global tariff war between the US and its major trading partners, including Canada, Mexico, China, and the EU, along with fears of a US recession, are at the forefront of investors' concerns.

Foreign portfolio investors (FPIs) have net sold stocks worth over Rs 30,000 crore in March, contributing to a total of nearly Rs 1.5 lakh crore for the year 2025. However, the pace of FPI selling is showing signs of slowing down, according to market players.

Key Data Releases and Market Directions

Investors are also keeping an eye on crucial data releases, including the FOMC interest rate decision, weekly US jobless claims, and India's wholesale price inflation for February. These factors, along with the dollar-rupee exchange rate, geopolitical developments in West Asia and Russia-Ukraine, and technical factors, are expected to guide the market's direction.

Commodities Market and Precious Metals

Following the Holi break, trading in the commodities market resumes with a focus on gold and silver prices in the domestic market. Gold prices in the international markets have recently surpassed the $3,000-per-ounce mark, reaching an all-time high, while silver prices are nearing a five-month high at approximately $34.5 per ounce.

Despite the global trade war's impact on market sentiments worldwide, the Indian economy's resilience offers some relief. However, domestic market momentum remains influenced by global trade uncertainties and the fear of a US recession. Falling crude oil prices, an easing dollar index, and expectations of a rebound in domestic earnings in the coming quarters may limit volatility and contribute to market stability amidst prevailing uncertainties.

Comments