Thailand's Property Market Faces Challenges

In 2024, 38 property developers listed on the Stock Exchange of Thailand (SET) saw a 27.16% drop in net profit. This decline is primarily due to aggressive pricing strategies aimed at attracting buyers, as explained by a real-estate consulting expert on Wednesday.

These companies reported a total revenue of 313.63 billion baht last year, marking a 4% decrease year on year, with combined profits shrinking to 27.42 billion baht, a 27.16% contraction from the previous year, according to Praphansak Rakchaiwan, CEO of LWS Wisdom and Solutions.

He highlighted the alarming nature of this profit contraction, pointing to the increasing hardships these companies face due to rising operational costs.

Strategies and Market Responses

In a market with slowing purchasing power, real estate developers often resort to price reductions and promotions to stimulate sales. While these strategies attract buyers, they can significantly erode profit margins.

Most developers also employed liquidity management strategies to navigate the challenging market conditions last year. The average profit margin in the real estate sector for 2024 was 8.74%, down from 11.52% in the previous year.

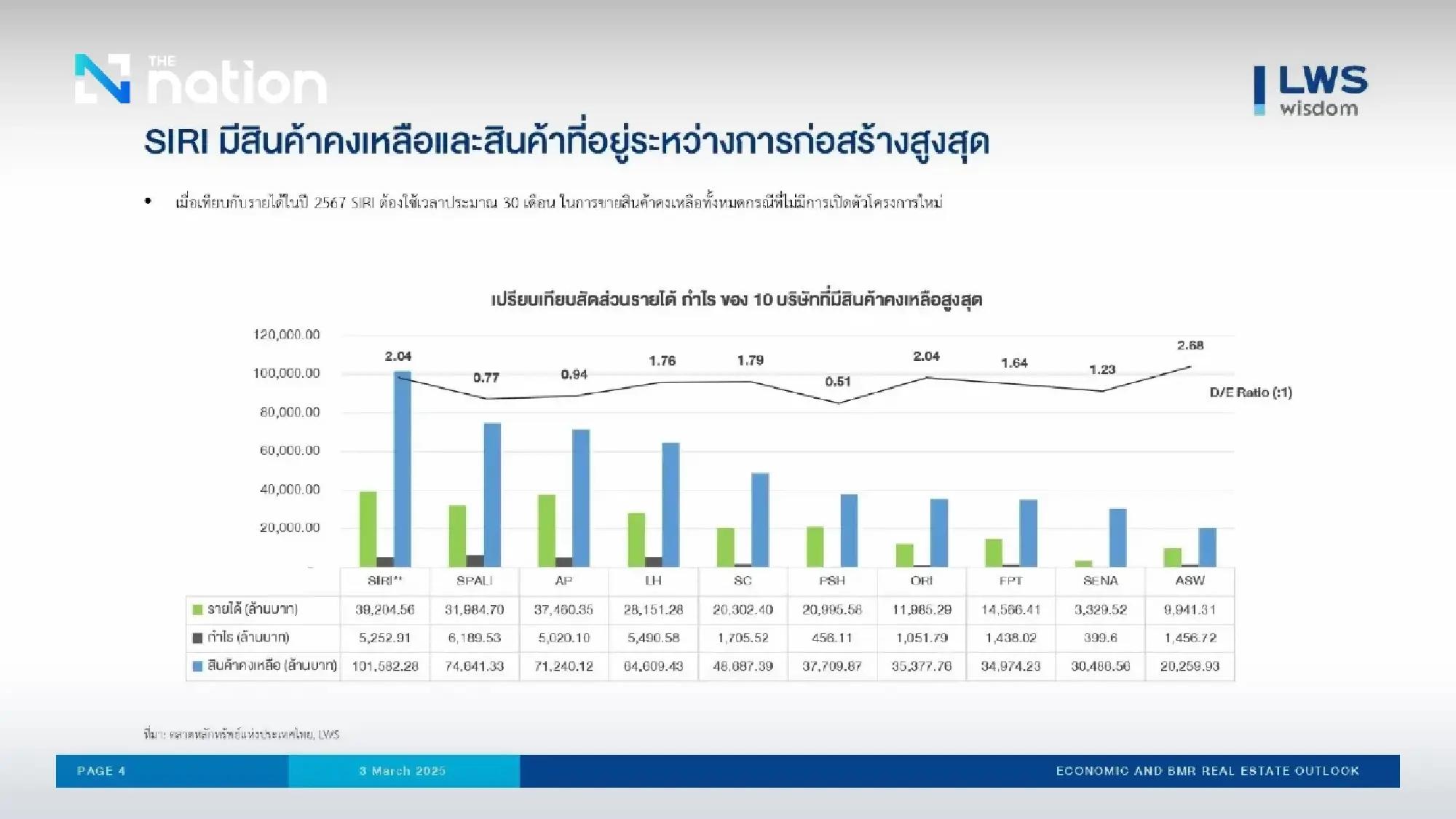

The value of unsold units and units under development increased by 7.5% year on year to 716.56 billion baht. Among the companies, Sansiri Plc has the highest value of unsold and under-development units at 101.58 billion baht, while also reporting the highest revenue in 2024 at 39.20 billion baht, up 2.03% year on year.

Future Outlook

Despite the overall decline in profits, Praphansak believes there are opportunities for recovery in the real estate market if strategies are properly adjusted. This includes focusing on effective liquidity management and finding ways to add value to projects under development.

He warned that increasing marketing campaigns may not be a long-term solution if they fail to improve profit margins. Real estate companies must find more sustainable ways to manage costs and add value for customers to meet the rapidly changing market demands.

Comments