Understanding the Dominance of Gujaratis in Equity Trades

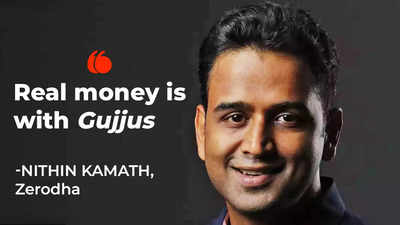

In a revealing social media post, Zerodha's co-founder and CEO, Nithin Kamath, shared intriguing insights into the geographical distribution of equity delivery trades in India. Highlighting the significant role of Gujarati investors, Kamath pointed out that Ahmedabad and Mumbai account for a staggering 80% of equity delivery trades. "Let that sink in. Essentially, the real money is with Gujjus," he remarked, using the colloquial term for Gujaratis.

Gujarat's Investment Landscape: A Closer Look

Despite Gujarat accounting for just 8% of the total registered investors, with its share declining, the state's impact on the equity market is undeniable. Kamath's analysis further revealed that Gujarat-based retail investors secured 39.3% of retail category allocations, with Maharashtra and Rajasthan trailing at 13.5% and 10.5%, respectively. This geographical distribution underscores the concentrated nature of equity investments in India, with approximately 70% of investors hailing from Gujarat, Maharashtra, Rajasthan, and Uttar Pradesh.

The IPO Phenomenon in Gujarat

Kamath also shed light on Gujarat's impressive involvement in Initial Public Offerings (IPOs), noting that while the state represents about 9% of the total investor customer base, it accounts for 40% of IPO participation in both retail and High Net-worth Individual (HNI) categories. This disproportionate contribution highlights the aggressive investment strategies employed by Gujarati investors, setting them apart in the Indian equity market.

Comments