New Delhi:

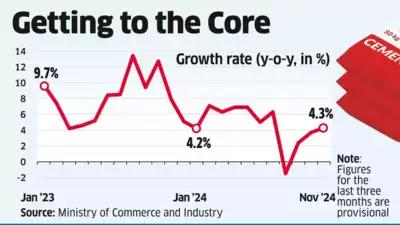

India's eight key infrastructure sectors witnessed a significant growth spurt, reaching a four-month high in November. This surge was primarily fueled by the cement, coal, and electricity sectors. According to the latest data released by the commerce and industry ministry, these sectors collectively grew by 4.3% in November, marking an increase from the 3.7% growth observed in October, albeit lower than the 7.9% growth recorded in the same month last year.

The core sectors, which include coal, crude oil, natural gas, petroleum/refinery products, fertilisers, steel, cement, and electricity, account for over 40% of the Index of Industrial Production (IIP). A robust performance in these sectors significantly impacts the IIP data, which is anticipated to be released later this month.

Highlighting the sectoral performance, cement production soared by 13% in November, a stark contrast to the 3.1% growth in October and a 4.7% contraction in November last year. The electricity sector also saw a rise, with a 3.8% increase compared to 2% in the previous month, though it was lower than the 5% growth in November last year.

Coal production maintained its strong performance, growing by 7.5% in November, nearly matching October's 7.8% growth and significantly higher than the 0.4% contraction in November last year.

However, not all sectors experienced growth. Crude oil and natural gas continued their downward trend, with crude oil contracting for the seventh consecutive month and natural gas for the fifth.

Aditi Nayar, chief economist at ICRA, commented on the growth, stating, "The core sector growth rose to 4.3% in November 2024 from a revised 3.7% in October 2024, with an improvement in half of its 8 constituents, partly reflecting the fading impact of heavy rainfall in the earlier months. The sequential uptick in the core sector's performance was especially driven by a sharp increase in the growth of cement output, on the back of a low base."

Looking ahead, Nayar expects the IIP to grow by 5-7% in November 2024, partly benefiting from the uptick in core sector growth.

Comments