Vietnam Stock Market Takes a Hit

The Vietnamese stock market closed the week on a down note, mirroring the broader Asian market trend. The index closed 4.78 points lower, following a 1.51-point drop in the previous session, marking a significant downturn for local investors.

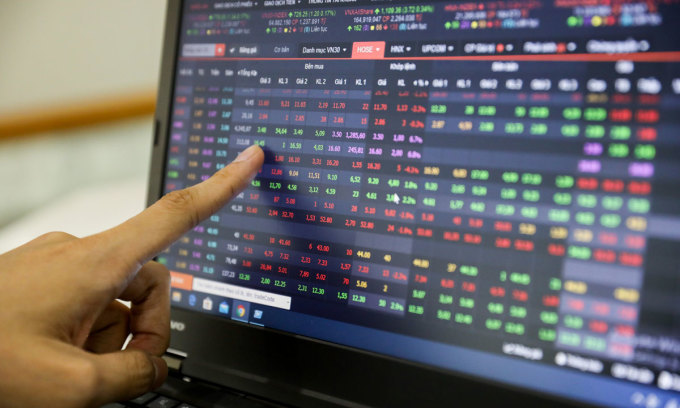

Trading volume on the Ho Chi Minh Stock Exchange decreased by 15%, amounting to VND11.417 trillion (US$449.4 million). The VN-30 basket, which includes the 30 largest capitalized stocks, saw 22 tickers decline, indicating a widespread loss across major companies.

Key Losses and Gains

Notable decliners included PLX of fuel distributor Petrolimex, which slid 1.8%, MSN of conglomerate Masan Group, down 1.4%, and HPG of steelmaker Hoa Phat Group, which dropped 1.1%. On the flip side, MWG of electronics retail chain Mobile World rose by 1.7%, VIB of Vietnam International Commercial Bank gained 0.8%, and STB of Ho Chi Minh City-based lender Sacombank closed 0.6% higher.

Foreign investors were net sellers, offloading VND24 billion, primarily from FPT of IT giant FPT Corporation and ACB of Asia Commercial Bank. Meanwhile, the HNX-Index for the Hanoi Stock Exchange and the UPCoM-Index for the Unlisted Public Companies Market also saw declines of 0.43% and 0.11% respectively.

Global Market Influence

The broader Asian market experienced a downturn as investors were disappointed by the lack of details on Chinese stimulus measures. The dollar strengthened due to the largest weekly rise in longer-dated Treasury yields in a year, reflecting reduced expectations for U.S. rate cuts in 2025. European stocks showed mixed results, while U.S. futures edged slightly higher. The British pound weakened following data revealing a contraction in the British economy for October.

China's blue-chip stocks and Hong Kong's Hang Seng Index both fell over 2%, influenced by the absence of new stimulus details from the Central Economic Work Conference. Europe's STOXX 600 equity index slipped 0.1%, with Britain's FTSE 100 and Germany's DAX showing modest gains of 0.14% and 0.36% respectively.

Comments