Global Stock Markets React Sharply to Trump's Tariff Announcement

Stock markets around the world experienced significant declines following former President Donald Trump's decision to impose high import tariffs on major trading partners. This move has raised fears of a global recession coupled with higher inflation, a scenario economists refer to as 'stagflation'. The CBOE Vix Volatility index, often considered Wall Street's fear gauge, surged to levels not seen since the pandemic-induced sell-off in March 2020.

Impact on Indian Markets

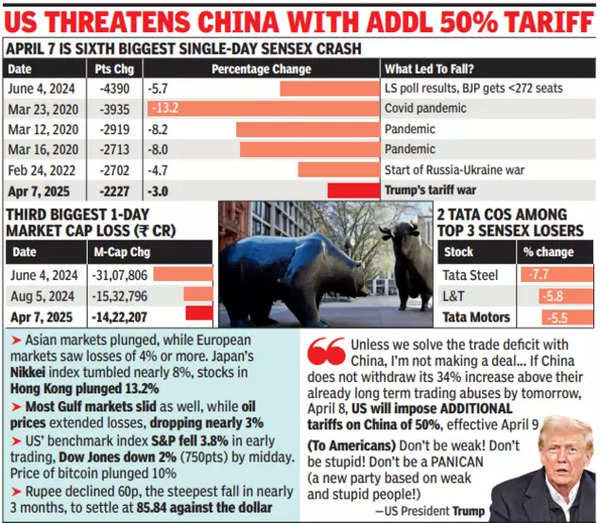

In India, the Sensex and Nifty both opened deep in the red, with losses exceeding 4% at the start of trading. Despite a partial recovery in the final hour, the Sensex closed down by 2,227 points, marking one of its largest single-day losses in history. Investors saw a staggering Rs 14.2 lakh crore wiped off their wealth, with BSE's market capitalisation dropping to Rs 389.3 lakh crore.

Global Reactions and Future Outlook

International markets, including the Nasdaq Composite, S&P, Dow Jones, and Japan's Nikkei, also faced steep declines. Experts suggest that the uncertainty surrounding the tariff war could keep markets volatile. However, India's strong domestic economy and potential policy interventions may offer some insulation from global shocks.

As the situation develops, investors and policymakers alike are bracing for further turbulence, with all eyes on upcoming economic indicators and potential central bank responses.

Comments