DAOL Asset Management Secures Landmark Settlement

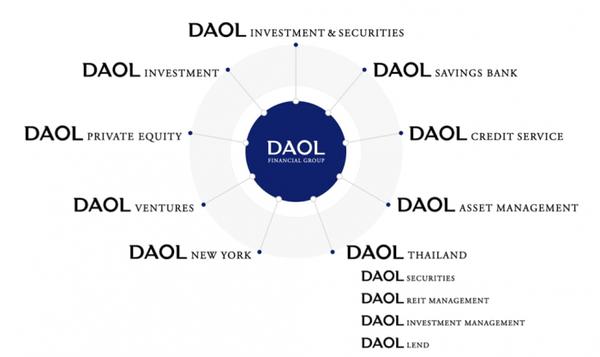

In a significant victory for international real estate investment, DAOL Asset Management, a subsidiary of DAOL Financial Group, has announced a $505 million settlement with Amtrak over the usage rights of Washington, D.C.'s Union Station. This settlement not only recovers the entire investment principal of $430 million but also secures an additional profit of $75 million, marking a rare success for domestic institutions in overseas real estate investments.

The Journey to Settlement

The investment saga began in 2018 when DAOL Asset Management, in partnership with U.S. operator Rexmark, invested in a $100 million mezzanine loan bond secured by Union Station's usage rights. The COVID-19 pandemic severely impacted the station's operations, leading to financial distress and the default of the loan bonds by early 2021. DAOL Asset Management's strategic decision to invest an additional $330 million in 2022 to acquire the senior loan bonds and become the owner of Union Station through lien execution was pivotal in reaching this settlement.

Challenges Ahead

Despite the settlement, DAOL Asset Management faces ongoing challenges, including a dispute with Ashkenazy, the original owner and borrower of Union Station. Legal disputes in real estate transactions often involve complex issues of ownership rights and financial obligations, which can lead to prolonged negotiations and litigation.

Implications for International Real Estate Investment

This case highlights the intricacies and potential risks and rewards of international real estate investment, particularly in times of financial distress. Mezzanine financing, a riskier form of investment subordinate to senior debt, played a crucial role in DAOL Asset Management's strategy, underscoring the importance of adept negotiation skills and strategic planning in navigating the complexities of such investments.

Comments