Government Plans Financial Support Package

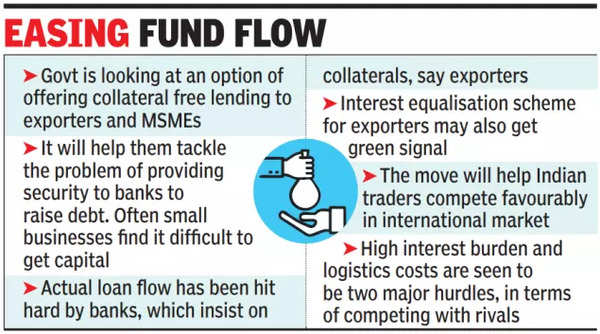

In a significant move to bolster the economy, the government is set to announce a comprehensive package aimed at enhancing financial support and credit facilities for exporters and small businesses. This initiative is expected to be a key highlight of the upcoming Budget, addressing the long-standing challenges faced by these crucial sectors.

Enhanced Credit Flow and Support Measures

The commerce department has already initiated discussions with the finance ministry to ensure a steady flow of credit and the availability of other financial instruments like factoring and credit guarantees. These measures are designed to alleviate the competitiveness issues faced by exporters, who have long struggled with financial constraints.

Collateral-Free Lending to Empower SMEs

One of the innovative solutions being considered is collateral-free lending, aimed at empowering micro, small, and medium enterprises (MSMEs). This approach is expected to significantly ease the burden on small businesses, particularly family-owned enterprises, by eliminating the need for security to secure loans.

Interest Equalisation Scheme to Boost Exports

The pending interest equalisation scheme is also anticipated to receive approval, offering a much-needed boost to Indian exporters. By reducing the interest burden and logistics costs, this scheme aims to enhance the competitive edge of Indian traders in the global market.

Driving Economic Growth Through Employment

The government's focus on supporting small businesses and exporters, especially in the manufacturing sector, underscores their potential as significant employment generators. By overcoming financial hurdles, these sectors are poised to drive overall economic activity and growth.

Comments