Historic Surge in Bond Investments

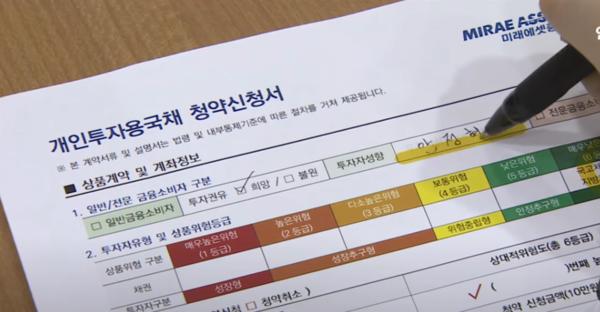

In an unprecedented move, South Korean individual investors have shattered records by net purchasing bonds worth over 40 trillion won last year, marking a significant milestone in the country's financial landscape. This remarkable achievement underscores the growing confidence and interest in bond investments among the general public.

Bank of Korea's Strategic Moves

The Bank of Korea's strategic interest rate cuts and South Korea's inclusion in the World Government Bond Index have played pivotal roles in this surge. By reducing the base interest rate and enhancing the country's global financial standing, these moves have made bonds more attractive to investors, leading to a significant increase in purchases.

Impact on the Bond Market

The ripple effects of these developments are evident in the bond market's performance. The yield on government bonds saw a notable decrease, making them a more appealing investment option. Furthermore, the corporate bond market also experienced a boost, with increased issuance and narrowed credit spreads indicating a robust recovery in investment demand.

Foreign Investors' Changing Trends

Contrasting with the domestic enthusiasm, foreign investors exhibited a more cautious approach towards the end of the year. Political uncertainties and fluctuations in the won-dollar exchange rate contributed to a slowdown in their net purchases of domestic bonds, highlighting the complex interplay of global and local factors influencing the bond market.

Comments