Rupee Falls Below 85 Against Dollar

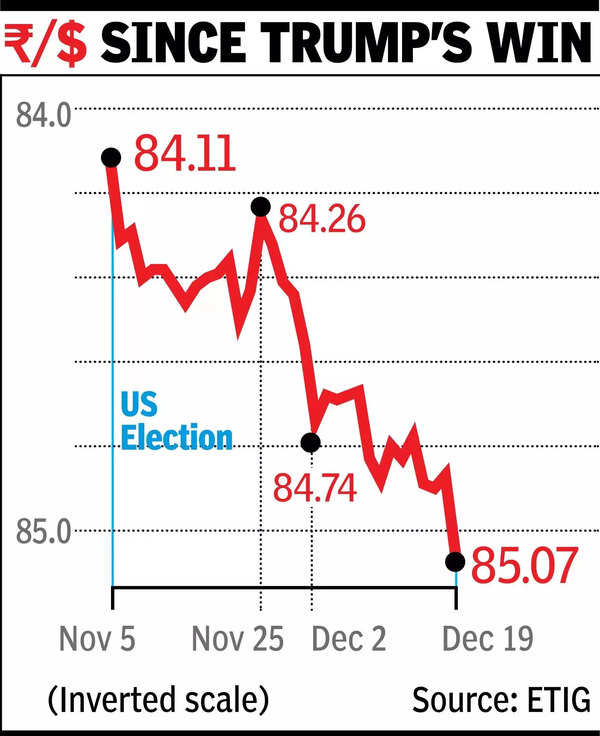

The Indian rupee breached the 85 level against the US dollar for the first time on Thursday, driven by the US Federal Reserve's indication of fewer rate cuts in the future. This development led the dollar to gain ground across most currencies, sparking concerns about the Reserve Bank of India's (RBI) potential response.

Madan Sabnavis, Bank of Baroda's chief economist, noted that forex reserves have decreased from over $700 billion to around $655 billion, and liquidity is tight for various reasons. The rupee's decline, though marginal in percentage terms, has raised alarms as the dollar strengthens against other currencies.

According to Reuters data, the rupee's drop to 85 from 84 has occurred in about two months, contrasting with the nearly 14 months it took to decline from 84 to 83. The currency's movement is not significant enough to impact foreign travel decisions but may slightly curb spending. A weaker rupee makes imports more expensive and pushes up headline inflation, but it also makes exports more competitive and helps manage the trade deficit.

Sabnavis added that currency movements will be compared across other currencies to gauge the rupee's position. He expects volatility to persist, potentially making for a turbulent holiday season in the markets. The treasury head of a private bank stated that while the rupee has crossed a psychological threshold by breaching 85, looking at forward rates from a year ago, the rupee is where it was expected to be. The currency is likely to remain rangebound.

Comments