Market Cap and Trading Volume Soar

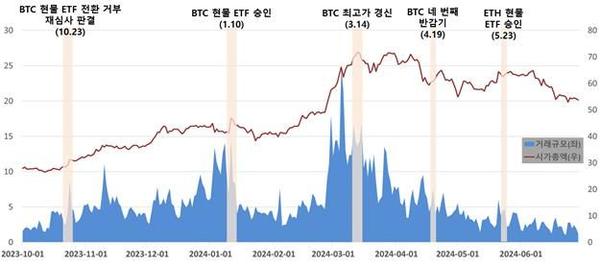

In the first half of 2024, the market capitalization of domestic virtual assets surged to 55.3 trillion won, marking a 27% increase from the second half of last year. This significant rise is attributed to the inflow of funds into the U.S. Bitcoin spot exchange-traded fund (ETF) and the announcement of virtual asset support policies by U.S. presidential candidates, which have collectively driven up virtual asset prices.

Financial Intelligence Unit's Survey Results

The Financial Intelligence Unit (FIU) under the Financial Services Commission released the "2024 First Half Virtual Asset Business Status Survey Results" on Oct. 31. The survey, which included 14 virtual asset exchanges such as Upbit, Bithumb, Coinone, Korbit, and 7 wallet and custody service providers, revealed a comprehensive overview of the virtual asset market's performance.

According to the survey, the average daily trading volume of virtual assets reached 6 trillion won, a 67% increase from the second half of last year. During the same period, KRW deposits also saw a modest rise of about 3%, totaling 5 trillion won. This surge in trading activity and deposits led to a remarkable 106% increase in the operating profit of exchanges, which recorded 590 billion won.

Market Dynamics and User Demographics

Despite the overall growth, the total number of virtual asset types decreased by 8%, bringing the count to 554. However, the price volatility of virtual assets increased by 8 percentage points, reaching 70%. Additionally, the amount of external transfers (withdrawals) of virtual assets surged by 96%, amounting to 74.8 trillion won.

The number of virtual asset trading users also saw a significant rise, increasing by 21% to reach 7.78 million. Analyzing the demographics, the largest group of users were in their 30s (29%), followed by those in their 40s (28%), those in their 20s and below (19%), those in their 50s (18%), and those in their 60s and above (6%).

Interestingly, the majority of users (5.24 million, 67%) held less than 500 thousand won in virtual assets. In contrast, the proportion of users holding assets worth 10 million won or more was 10% (780 thousand), and 104 thousand users (1.3%) held assets worth 100 million won or more.

Global Market Cap and Future Outlook

On a global scale, the virtual asset market cap in the first half of this year reached 3,125 trillion won, a 46% increase from 2,143 trillion won at the end of last year, based on data from CoinMarketCap.

The FIU commented on these findings, stating, "The trend of rising virtual asset prices and expanding market size that started in the second half of last year continues into the first half of this year." They further added, "Compared to the end of last year, trading volume, market cap, KRW deposits, and the number of users have all increased, and the total operating profit of virtual asset exchanges has also significantly increased."

The introduction of Bitcoin spot ETFs has made it easier for traditional investors to gain exposure to the cryptocurrency market without directly purchasing Bitcoin. This has likely contributed to the increased market capitalization and trading volume observed in the first half of this year.

Comments